Hi, I’m Damodar Arapakota. I’ve been an engineer, technology entrepreneur, and startup mentor for over 30 years. I’m about to embark on the next phase of my journey: setting up a venture capital fund to invest in high-growth potential startups. As part of this process, I’ve recognized that some potential investors in my network may not be familiar with the benefits of venture fund investment. If you are an accredited investor who traditionally only takes stakes in real estate, mutual funds, or public markets, this blog post is for you, so that you can better understand investing in venture capital funds.

Investors often tell me they want to invest in hot, disruptive, and proven technology companies. The average investor learns about these companies when they are well known and ready to IPO, or have already completed their IPO. The share prices of these companies are high.

Investors can certainly invest in these companies and benefit from reasonable returns. But they are missing out on the even greater potential returns from investing in these companies at an earlier stage of growth. A smaller-scale investment in a highly promising early-stage company can result in significant returns when the company exits through an IPO or sale.

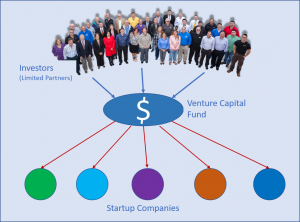

But there is an information and access problem. The average investor does not know how to find and identify promising early-stage companies. This is where venture capital firms come in. Venture capital firms are singularly focused on identifying promising startups. They do the leg work and due diligence to find high potential companies. Venture capital firms get investments from multiple investors (called Limited Partners), and in turn, invest in startups. When it’s time for a company to be sold or IPO, early venture capital investment in early-stage startups can result in much higher returns to Limited Partners than if they made only traditional investments.

Investment in venture capital funds is growing rapidly and becoming a recognized asset class for investors. Over $128 Billion was invested in venture capital funds in 2021. Depending on the size of the fund, the investments can range from thousands to millions of dollars.

According to available data, venture capital fund returns far exceed returns from the public markets (Venture Capital Index from Cambridge Associates). Venture capital fund investment as an asset class has outperformed in recent years. The latest Global Fund Performance Report from PitchBook shows that one-year and three-year horizon IRRs for venture capital funds have significantly outpaced every other private capital asset class, including private equity, secondaries, real estate, real assets, private debt, and funds of funds. Exits were a huge part of the story of 2021, with approximately $774.1 billion in annual exit value created by VC-backed companies that either went public or were acquired (Source: PitchBook).

Consider investing in venture capital funds for the following additional reasons:

- Venture capital firms invest in multiple startups, reducing risks to the investor

- Through venture capital firms, investors can access potential gains that they were previously blocked from due to lack of access/knowledge

- Venture capital fund investments help diversify investors’ existing portfolios

- Venture capital gives investors the opportunity to invest in the next generation of innovative companies in technology as well as in the areas of social or environmental impact

That said, venture capital fund investments are certainly riskier than traditional investment types. However, working with a knowledgeable venture capital firm can yield high rewards – it’s up to you as the investor to determine your best options.